Finance Programs and Objectives

He wrote that there were shocks or triggers (i.e., particular events that touched off the crisis) and vulnerabilities (i.e., structural weaknesses in the financial system, regulation and supervision) that amplified the shocks. The combined balance sheets of the then five major investment banks totaled $4 trillion. Even with bad credit, payday loans are available from ace cash express. As these mortgages began to default, the three agencies were compelled to go back and redo their ratings. They also amplified the losses from the collapse of the housing bubble by allowing multiple

subprime commercial truck loans canada bets on the same securities and helped spread these bets throughout the financial system. Having more spare cash around to cope with unexpected owner-operator expenses that you did not foresee will be less risky compared to sinking everything you have into the best semi trailer truck on the market.

Structuring involved "slicing" the pooled mortgages into "tranches", each having a different priority in the stream of monthly or quarterly principal and interest stream.[121][122] Tranches were compared to "buckets" catching the "water" of principle and interest. France and Italy had no significant changes, while in Germany and Iceland the unemployment rate declined.[295] Eurostat reported that Eurozone unemployment reached record levels in September 2012 at 11.6%, up from 10.3% the prior year. It uses cost sharing and incentives to encourage lenders to reduce homeowner's monthly payments to 31 percent of their monthly income.

Free Sample Letter For Tenant Improvement Reimbursement

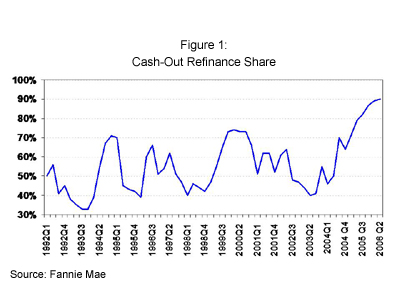

In 2004 it rose to 4.0, and by 2006 it hit 4.6.[61] This housing bubble resulted in quite a few homeowners refinancing their homes at lower interest rates, or financing consumer spending by taking out second mortgages secured by the price appreciation. Even looser was the "payment option" loan, in which the homeowner has the option to make monthly payment that do not even cover the interest for the first two or three year initial period of the loan. Mortgage underwriting standards declined precipitously during the boom period. In addition, investors who hold MBS and have a say in mortgage modifications have not been a significant impediment; the study found no difference in the rate of assistance whether the loans were controlled by the bank or by investors. In 1982, Congress passed the Alternative Mortgage Transactions Parity Act (AMTPA), which allowed non-federally chartered housing creditors to write adjustable-rate mortgages. When Lehman Brothers and other important financial institutions failed in September 2008, the crisis hit a key point.[313] During a two-day period in September 2008, $150 billion were withdrawn from USA money funds.

Bank Owned Properties

Examples of vulnerabilities in the public sector included. Insofar at Fannie and Freddie did purchase substandard loans, some analysts question whether government mandates for affordable housing was the motivation. While the housing and credit bubbles were growing, a series of factors caused the financial system to become increasingly fragile. If i have income that s not reported on getting a car loan with schedule e income my tax return, can it be considered. Further, this pool of money had roughly doubled in size from 2000 to 2007, yet the supply of relatively safe, income generating investments had not grown as fast. However, there are some things you need to know regarding used truck loans with bad credit.

This 100-page document represented the viewpoints of HUD, Fannie Mae, Freddie Mac, leaders of the housing industry, various banks, numerous activist organizations such as ACORN and La Raza, and representatives from several state and local governments.” [196] In 2001, the independent research company, Graham Fisher & Company, stated. The Fed believed that interest rates could be lowered safely primarily because the rate of inflation was low; it disregarded other important factors. However, this rebate coincided with an unexpected jump in gasoline and food prices. From the end of World War II to the beginning of the housing bubble in 1997, housing prices in the US remained relatively stable.[58] The bubble was characterized by higher rates of household debt and lower savings rates, slightly higher rates of home ownership, and of course higher housing prices.

Assets held in hedge funds grew to roughly $1.8 trillion. The balance of payments identity requires that a country (such as the U.S.) running a current subprime commercial truck loans canada account deficit also have a capital account (investment) surplus of the same amount. However, if you buy a new big rig with commercial truck loans for bad credit, the main brunt of vehicle depreciation will be borne by you and you can suffer a lot of losses when it comes to selling off the truck on the used big rig market. Sales were slow; economists estimated that it would take three years to clear the backlogged inventory. It is actually easier to get bad credit truck leasing and you can start your own commercial trucking biz with lesser capital or when you are unsure whether you can sustain a living doing so.

In our estimation the best debt help firms are national debt relief, curadebt, and. Several sources have noted the failure of the US government to supervise or even require transparency of the financial instruments known as derivatives[261][262][263] A 2008 investigative article in the Washington Post found that leading government officials at the time (Federal Reserve Board Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt) vehemently opposed any regulation of derivatives. Why was there a market for these low quality private label securitizations. If you have high FICO scores, you can enjoy cheaper used truck loans from prime lenders and banks.

Treasury bonds and thus avoided much of the direct impact of the crisis. Their bonuses were heavily skewed towards cash rather than stock and not subject to "claw-back" (recovery of the bonus from the employee by the firm) in the event the MBS or CDO created did not perform. Insurance companies such as American International Group (AIG), MBIA, and Ambac faced ratings downgrades because widespread mortgage defaults increased their potential exposure to CDS losses. Assets financed overnight in triparty repo grew to $2.5 trillion.

Of these, Fannie & Freddie held or guaranteed 12 million mortgages valued at $1.8 trillion. In 1995 the Clinton Administration issued regulations that added numerical guidelines, urged lending flexibility, and instructed bank examiners to evaluate a bank’s responsiveness to community activists (such as ACORN) when deciding whether to approve bank merger or expansion requests. These losses impacted the ability of financial institutions to lend, slowing economic activity.

If you have explored all of mortgage with bankruptcy the alternatives and have. Krugman explained in July 2011 that the data provided by Pinto significantly overstated the number of subprime loans, citing the work of economist Mike Konczal. Pinto estimated that by early 2008 there were 27 million higher-risk, "non-traditional" mortgages (defined as subprime and Alt-A) outstanding valued at $4.6 trillion.

When buying a used commercial truck with poor credit, you may have problems trying to refinance the loan quickly or sell off the vehicle if something goes wrong. Critics claim that the 1995 changes to CRA signaled to banks that relaxed lending standards were appropriate and could minimized potential risk of governmental sanctions. Speculative borrowing in residential real estate has been cited as a contributing factor to the subprime mortgage crisis.[83] During 2006, 22% of homes purchased (1.65 million units) were for investment purposes, with an additional 14% (1.07 million units) purchased as vacation homes. My contacts 24/7 are 484-678-8030 or jcosgrove@cagcorp.com. By late 2006, the average home cost nearly four times what the average family made. Central banks have generally chosen to react after such bubbles burst so as to minimize collateral damage to the economy, rather than trying to prevent or stop the bubble itself.

More senior buckets didn't share water with those below until they were filled to the brim and overflowing.[123] This gave the top buckets/tranches considerable creditworthiness (in theory) that would earn the highest "triple A" credit ratings, making them salable to money market and pension funds that would not otherwise deal with subprime mortgage securities. Internet faxing and virtual fax send and receive faxes by email with a. Further, major investment banks which collapsed during the crisis subprime commercial truck loans canada were not subject to the regulations applied to depository banks. It concluded that "the crisis was avoidable and was caused by.

Junk My Car Official Site

The debate arises because this accounting rule requires companies to adjust the value of marketable securities (such as the mortgage-backed securities (MBS) at the center of the crisis) to their market value. Given the political implications of such austerity, the temptation will be to default by stealth, by letting their currencies depreciate. Several major financial institutions either failed, were bailed-out by governments, or merged (voluntarily or otherwise) during the crisis. As a result of the depreciating housing prices, borrowers ability to refinance became more difficult. The Glass-Steagall Act was enacted after the Great Depression. Governments also bailed out key financial institutions, assuming significant additional financial commitments.

Cash Loans Up To 1500

The Financial Crisis Inquiry Commission reported in January subprime commercial truck loans canada 2011 that CDS contributed significantly to the crisis. The crisis can be attributed to a number of factors pervasive in both housing and credit markets, factors which emerged over a number of years. America must regain its competitiveness through innovative products, training of production workers, and business leadership. The very nature of many Wall Street firms changed — from relatively staid private partnerships to publicly traded corporations taking greater and more diverse kinds of risks. To buy a truck with bad credit, a higher down payment of 20% will help guarantee loan approval. The critics believe that changes in the capital reserve calculation rules enabled investment banks to substantially increase the level of debt they were taking on, fueling the growth in mortgage-backed securities supporting subprime mortgages.

Cheaper and easier to create than original "cash" CDOs, synthetics did not provide funding for housing, rather synthetic CDO-buying investors were in effect providing insurance (in the form of "credit default swaps") against mortgage default. Warren, I spent 10 years at DZ Bank, lending to the types of independent finance companies you're looking for. Due to increasing fuel prices and the weak economic performance over the last three years, there is a surplus of used commercial trucks on the second hand vehicle market. If you are looking to buy used semi trailer trucks in good working condition, the prices are at a very attractive discount now. However, with the exception of Germany, each of these countries had public-debt-to-GDP ratios that increased (i.e., worsened) from 2010 to 2011, as indicated in the chart at right.

Financial institutions invested foreign funds in mortgage-backed securities. His dissent relied heavily on the research of fellow AEI member Edward Pinto, the former Chief Credit Officer of Fannie Mae. At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

Subprime loans have a higher risk of default than loans to prime borrowers.[24] If a borrower is delinquent in making timely mortgage payments to the loan servicer (a bank or other financial firm), the lender may take possession of the property, in a process called foreclosure. Historically it was between two and three times. Influential figures should have proclaimed a simple rule.

Vystar credit union home page in jacksonville, fl. With the high down payments and credit scores of the conforming mortgages used by GSE, this danger was minimal.[118] Investment banks however, wanted to enter the market and avoid competing with the GSEs.[119] They did so by developing mortgage-backed securities in the riskier non-conforming subprime and Alt-A market. Defaults and losses on other loan types also increased significantly as the subprime commercial truck loans canada crisis expanded from the housing market to other parts of the economy. You incur much lower initial upfront investment costs compared to buying a new big rig that can cost from $50000 to $250000 for fully equipped Freightliner 18-wheelers.

The response of the USA Federal Reserve, the European Central Bank, and other central banks was immediate and dramatic. See subprime auto loans for characteristics of loans we recently originated. The sum of the surpluses or deficits across these three sectors must be zero by definition. CAG Truck Capital is a direct lender and direct funding source for Class 8 truck deals with 'story' credits.

Author Michael Lewis wrote that CDS enabled speculators to stack bets on the same mortgage bonds and CDO's. However, if you buy a new big rig with commercial truck loans for bad credit, the. In a healthy economy, private sector savings placed into the banking system is borrowed and invested by companies. The problem was that even though housing prices were going subprime commercial truck loans canada through the roof, people weren't making any more money. Very large losses will, no doubt, be taken as a consequence of the crisis.

A contributing factor to the rise in house prices was the Federal Reserve's lowering of interest rates early in the decade. These entities became critical to the credit markets underpinning the financial system, but were not subject to the same regulatory controls as depository banks. The Commodity Futures Modernization Act of 2000 was bi-partisan legislation that formally exempted derivatives from regulation, supervision, trading on established exchanges, and capital reserve requirements for major participants. Some analysts believe the subprime mortgage crisis was due, in part, to a 2004 decision of the SEC that affected 5 large investment banks. What these "private label" or "non-agency" originators did do was to use "structured finance" to create securities.