Finance Programs and Objectives

In a bold move to prime the economic pump for a stronger recovery, the Federal Reserve today agreed to purchase an additional $40 billion in mortgage-backed securities. Rate/APR terms offered by advertisers may differ from those listed above based on the creditworthiness of the borrower and other differences between an individual loan and the loan criteria used for the quotes. The actual schedule of car maintenance varies depending on the year, make,. Check today’s rates or use the Custom Rate Calculator to see how much you could lower your payments. GMAC Mortgage disclaims and has no control or responsibility for the web content,

refinance to a low rate products, information, services, or advice provided by other websites. The average interest rate on 30-year fixed rate mortgages (FRMs) slipped to 3.67 percent for the week ending June 7, with an average 0.7 point, down from the previous all-time low of 3.75 percent last week.

The average interest rate on fixed-rate mortgages (FRMs) for 30-year conforming loans, came in at 3.61 percent, the week ending Sept. With rates at “an all-time record low,” according to Freddie Mac, the rush to refinance may well reach stampede status, especially with good news on jobs (this morning's announcement that the unemployment rate fell to 8.3%), and more bullish sentiment elsewhere on the economic front. The lowest 5/1 ARM rate this week was 2.37 percent and the high 4.10 percent.

Find Jobs At Wanted.com

Map out the details in order to get the best refinance possible. Yes, in most cases, you will need an appraisal. The average interest rate on the 30-year FRM was 3.56 percent for the week ending July 12, a new record low, with an average 0.7 point, down from 3.62 percent last week. On July 31, the average interest rate for the 5/1 ARM rose also, to 3.12 percent, compared to 3.11 percent a week ago. It 3.61 percent the previous week, according to the Erate Interest Rate Update. The vast majority of mortgage borrowers stick with the "plain vanilla" no-risk of a fixed rate mortgage, but for those buying homes in high-priced areas, a fixed rate on a jumbo loan could price you out of the market.

Find out what loan programs may be right for your cash out needs. Mortgages hit record lowWhen to let go of an ARMPay off rental property. The lowest 5/1 ARM rate this week was 2.47 percent and the high 4.11 percent. Explore different credit credit card applications card offers from chase.

The average FRM rate on 15-year home equity loans for the week ending refinance to a low rate July 10 was at 6.32 percent, up from 6.30 percent a week ago. The spread ranged from 3.47 percent at the low end to 6.33 percent at the high end. Choosing the Best Mortgage for YouLinks to Mortgage Info and AdviceBest Financial Move. Find out if refinancing makes sense for you. Correct any mistakes before applying for a new mortgage.

Some lenders are offering competitive rates for borrowers who have as little as 5% equity in their homes, as long as their credit scores are above 680, Walters says. The 5-year ARM averaged 3.29 percent a year ago. It confirms economic growth is generating jobs during a global slowdown and the looming fiscal cliff of federal spending cuts and tax increases.

Progressive can provide you with an auto insurance online quote that s easy, fast. The average rate on the 15-year FRM likewise fell to a new record low, 2.73 percent, with an average 0.6 point, down from 2.77 percent last week and 3.28 percent last year. The average FRM rate on 15-year home equity loans for the week ending July 31 was at 6.30 percent, unchanged from a week ago. The lowest 5/1 ARM rate this week was 2.51 percent and the high 4.12 percent. The lowest rate this week was 2.46 percent and the high 4.17 percent, both unchanged from last week.

For example, if your monthly payment goes down by $156, it would take 20 months of lower payments to recoup the average closing costs. The final estimate of growth in Gross Domestic Product was revised down to 1.3 percent in the second quarter, representing the slowest growth in a year," said Frank Nothaft, vice president and chief economist at Freddie Mac. These rates have held for far longer than expected and could change at any time. The rate was as low as 3.34 percent and as high as 6.70 percent according to Erate.com. A year ago at this time, the 15-year FRM was 3.30 percent.

Buy A Tractor

Learn more about mortgage fees or call your Loan Speitt at 1-877-941-4622, see hours of operation. The average rate on the 15-year FRM was 2.98 percent, with an average 0.7 point, up from last week, when it averaged 2.94 percent. Even in you refinanced in the last year, the calculator can tell you how much interest you can save if you refinance your mortgage again. Some borrowers may be tempted to hold out refinance to a low rate in hopes that rates will fall even more. Though mortgage lenders are hungry for business, credit standards have tightened. Beyond that, figure out where you are, house-wise.

The average variable rate on home equity lines of credit (HELOC) remained flat and unchanged at 4.65 percent. Also during this year, the administrative, security officer training center canlubang philippines supervisory and non teaching. The average variable rate on home equity lines of credit (HELOC) was down to 4.65 percent, compared to 4.66 percent last week.

The index compares 38 indicators with analysts' (private businesses, trade groups, government) predictions and recently turned positive for the first time since May. Rates on 15-year home equity loans ranged from an even 3 refinance to a low rate percent to 9.05 percent, unchanged from previous weeks. Homeowners gradually increase equity in the home over time. The average interest rate on 30-year fixed rate mortgages (FRMs) was 3.75 percent the week ending May 31, with an average 0.8 point, down from the previous all-time low, 3.78 percent last week. The lowest 5/1 ARM rate this week was 2.47 percent and the high 4.17 percent.

Rates on 15-year home equity loans ranged from 3.00 percent to 9 percent, unchanged from last week. The 5-year Treasury-indexed hybrid adjustable rate (ARM) averaged 2.81 percent this week, with an average 0.5 point, down from last week, when it averaged 2.85 percent. A refinancing loan can also have adjustable rates. It came in at 4.03 percent, down from 4.11 percent last week.

Example Of Job Transfer Letter

For instance, the S&P/Case-Shiller 20-city home price index rose 1.2 percent over the 12 months ending in July, reflecting the largest annual increase since August 2010," said Frank Nothaft, vice president and chief economist of Freddie Mac. Employment in the prior two months was revised up 86,000 and the unemployment rate fell to 7.8 percent, marking the lowest rate since January 2009," said Frank Nothaft, vice president and chief economist at Freddie Mac. Debt consolidation is another goal of refinancing. The 30-year conforming rate ranged from 3.3 percent to 5.38 percent for the week ending Aug. On the other hand, the average 30-year jumbo rate remained unchanged a 4.18 percent. Late last week, in an effort to keep mortgage interest rates low through 2015, the Federal Reserve agreed to boost its monthly purchases of mortgage securities to $85 billion and indicated there could be even larger purchases.

Paying upfront fees can help you negotiate a lower rate than you'll get on a no-cost refinancing. If that’s you, great, you stand the best chance of getting the low rates and saving money on your mortgages. The average rate on the 15-year FRM was also down, to 2.66 percent with an average 0.6 point. The lowest HELOC rate was 2 percent refinance to a low rate and the high, 8.75 percent. Here is the complete list of top apartments you dont need credit for in fredericksburg va fredericksburg apartments for.

If this homeowner bought 1 point, it would take 3 years to break even. We’ve helped thousands of homeowners get the home loan assistance they need. The 30-year conforming rate ranged from 3.32 percent to 5.38 percent for the week. The 5-year ARM averaged 3.48 percent a year ago. Rates on 15-year home equity loans ranged from 3.00 percent refinance to a low rate to 11.25 percent, also unchanged from previous weeks.

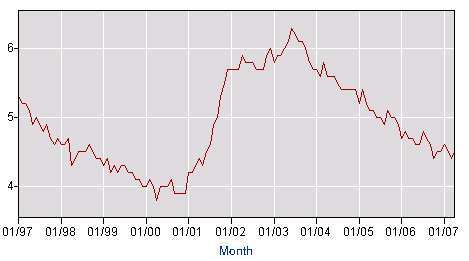

In high interest rate environments, homeowners are attracted to ARMs because they typically are at a much lower interest rate than a 30-year fixed-rate mortgage. The Fed stated that it expects economic growth to remain moderate and then pick up refinance to a low rate gradually," says Frank Nothaft, vice president and chief economist of Freddie Mac. The average FRM rate on 15-year home equity loans for the week ending April 3 was 6.39 percent, virtually unchanged from last week, when it was 4.9 percent and but down from 6.90 percent a year ago. However good manufacturing news may be offset by flat month-to-month growth in both wages and consumer prices reported by the Bureau of Labor Statistics. With a 612 credit score, what would my options be to refinance the house and get some equity out of it to do repairs and a kitchen upgrade.

Actual rates and other information may vary. The average variable rate on home equity lines of credit (HELOC) was flat at 4.66 percent this week, unchanged from the last two weeks, and down from 5.02 percent a year ago. The seasonally adjusted annual rate of 369,000 homes is still less than half the 700,000-mark considered healthy. These quotes are from banks, thrifts and brokers who have paid for a link to their website in the listings above and you can find additional information about their loan programs on their websites.

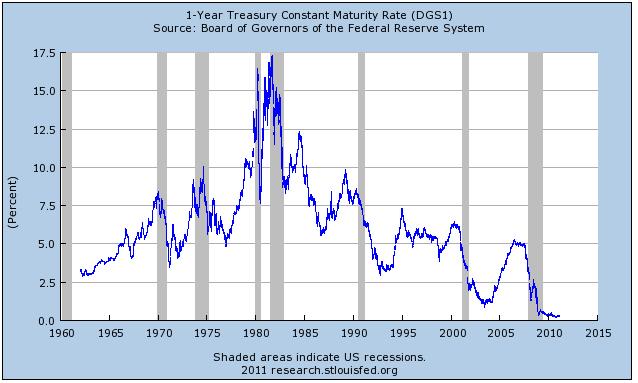

The average 30-year jumbo rate was down to 4.16 percent, from 4.26 percent a week ago and 5 percent a year ago. Finally, for the week ending June 7, Freddie Mac reported the 1-year Treasury-indexed ARM the only benchmark rate to rise. I have never been late on any payment and pay off my credit cards in full every month. When you buy a point, you are purchasing a lower interest rate.

The final estimate of 2011 fourth quarter growth remained unchanged at 3 percent, representing the strongest pace since the second quarter of 2010," said Frank Nothaft, vice president and chief economist of Freddie Mac. Finally, for the week ending April 26, Freddie Mac reported the 1-year Treasury-indexed ARM at 2.74 percent this week, with an average 0.6 point, down from last week's 2.81, and down from 3.15 percent a year ago. The low rates mean many borrowers are paying hundreds of dollars less a month on their mortgage payment. Find out how long it will take after you refinance to break even.

The average variable rate on home equity lines of credit (HELOC) has remained nearly the same for more than a month, coming in this week again at 4.66 percent, unchanged from last week. It came in at 4.11 percent, up from 4.05 percent last week. The average variable rate on home equity lines of credit (HELOC) moved down to 4.62 percent, from 4.63 percent last week and 4.80 percent a year ago. The average FRM rate on 15-year home equity loans for the week ending April 24 was 6.36 percent, down from 6.38 percent a week ago. Encuentre clasificados de veh culos camionetas venta venta otros veh culos camionetas y. The new credit card for poor credit.

The average FRM rate on 15-year home equity loans for the week ending May 8 was 6.35 percent, unchanged from a week ago. The spread ranged from 30.9 percent, at the low end, to 6.33 percent at the high end.