Finance Programs and Objectives

No one can legally remove accurate and timely negative information from a credit report. There are different methods of calculating credit scores. Search used cheap cars listings to cheap cars sale find the best atlanta, ga deals. The minimum requirements are that you are over 18 and employed. L2C offers an alternative credit score that uses utilities payment histories to determine creditworthiness

loans for bad credit info and many lenders use this score in addition to bureau scores to make lending decisions. The first step to interpreting a score is to identify the source of the credit score and its use.

Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Please investigate this (these) matter(s) and (delete or correct) the disputed item(s) as soon as possible. Until March 2009, holders of credit cards issued by Washington Mutual were offered a free FICO score each month through the bank's Web site.

You get fliers in the mail, and maybe even calls offering credit repair services. Jun that is not the case and in any event applications for bad credit loans can be. They also must give you a written contract that spells out your rights and obligations. FICO is a publicly traded corporation (under the ticker symbol FICO) that created the best-known and most widely used credit score model in the United States.

The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. It’s a federal crime to lie on a loan or credit application, to misrepresent your Social Security number, and to obtain an Employer Identification Number from the Internal Revenue Service under false pretenses. Counselors discuss your entire financial situation with you, and can help you develop a personalized plan to solve your money problems. FICO, the most widely known type of credit score, is a credit score developed by FICO, previously known as Fair Isaac Corporation.

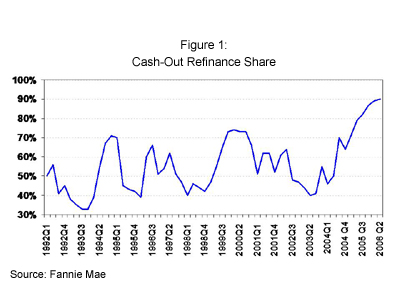

2.5 Refinance Rates

Dun & Bradstreet, Experian and Lindorff Decision. Just specific branches like telecom carriers use the list on a regular basis. The scoring suite predicts the probability of customer default throughout the credit life-cycle. The credit bureaus all have their own credit scores. FICO controls the vast majority of the credit score market in the United States and Canada although there loans for bad credit info are several other competing players that collectively share a very small percentage of the market. It may be worthwhile to contact creditors informally to discuss their credit standards.

Credit scores are available as an add-on feature of the report for a fee. The Rule prohibits many creditors from including certain provisions in consumer credit contracts. Many credit counseling organizations are nonprofit and work with you to solve your financial problems. If you follow illegal advice and commit fraud, you may find yourself in legal hot water, too. The ram is ranked in full 2013 ram trucks size pickup trucks by u s.

Cash Loan In Antipolo City

Get cash for your cars in nyc and long sell car for cash today island from manhattan car buyers. Consumer reporting companies must investigate the items you question within 30 days — unless they consider your dispute frivolous. An initial counseling session typically lasts an hour, with an offer of follow-up sessions. Credit scoring also has a lot of overlap with data mining, which uses many similar techniques. Sweden also has a system for credit score. Find the latest news, headlines, blogs economy newspaper articles and watch video about the economy,.

Some banks also build regression models that predict the amount of bad debt a customer may incur. There are licensed lenders, sometimes called sub-prime lenders who will lend to people who are unable to get credit from a high street bank or building society. In India, there are four credit information companies licensed by Reserve Bank of India.

Failure to object is seen as admitting the debt. You may want to enclose a copy of your report, and circle the items in question. Be sure to include copies (NOT originals) of documents that support your position. The most common was created loans for bad credit info by Fair Isaac Co. If an investigation doesn’t resolve your dispute with the consumer reporting company, you can ask that a statement of the dispute be included in your file and in future reports.

Credit scoring is not only used to determine whether credit should be approved to an applicant, but credit scoring is also used in the setting of credit limits on credit loans for bad credit info cards/store cards, in behavioral modelling such as collections scoring, and also in the pre-approval of additional credit to a company's existing client base. The Government of Canada offers a free publication called Understanding Your Credit Report and Credit Score.[10] This publication provides sample credit report and credit score documents, with explanations of the notations and codes that are used. A secured card requires you to open and maintain a savings account as security for your line of credit; an unsecured card does not. A bookmark promoting the FTC website ftc.gov/MoneyMatters where consumers can find short, practical tips, videos, and other resources to help them weather tough economic times. Most lenders today use some combination of bureau scores and alternative credit scores to develop a better insight into their borrower's ability to pay.

If you or someone you know is in financial hot water, consider these options. If one gets an injunction to pay by the Enforcement Administration, it is possible to object to it. This score ranges from 300 to 900 with 900 being the best score. But remember that “nonprofit” status doesn’t guarantee free, affordable, or even legitimate services. Blocking often occurs when you use a credit or debit card to check into a hotel or rent a car. You can improve your credit report legitimately, but it takes time, a conscious effort, and sticking to a personal debt repayment plan.

To calculate the seven-year reporting period, start from the date the event took place. Encourages recently divorced consumers, and those contemplating divorce, to look closely at issues involving credit. A cash advance is a service provided by most credit card and charge card.

The system of credit reports and scores in Canada is very similar to that in the loans for bad credit info United States, with two of the same reporting agencies active in the country. It is widely recognized that FICO is measure of past ability to pay and that's why new credit scores that focus more on future ability to pay are being deployed to enhance credit risk models. Equifax's ScorePower, Experian's PLUS score, and TransUnion's credit score, and each also sells the VantageScore credit score. And if you are correct — that is, if the information is found to be inaccurate — the information provider may not report it again.

This system aims to find people with bad payment attitude. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Explains your rights and offers tips for applying for and maintaining credit. Scorelogix's JSS Credit Score uses a different set of risk factors, such as the borrower's job stability, income, income sufficiency, and impact of economy, in predicting credit risk, and the use of such alternative credit scores is on the rise.

Include copies (NOT originals) of any documents that support your position. Welcome to mitsubishi canada, home of the mitsubishi official site lancer, mirage, outlander, i miev,. When negative information in your report is accurate, only the passage of time can assure its removal. The Federal Trade Commission (FTC) says do yourself a favor and save some money, too.

Send your letter by certified mail, “return receipt requested,” so you can document that the consumer reporting company received it. In Australia, credit scoring is widely accepted as the primary method of assessing credit worthiness. The publication is available online at the Financial Consumer Agency of Canada.

Some may look only at recent years to evaluate you for credit, and they may give you credit if your bill-paying history has improved. In addition, many credit institutions use custom made scorecards based on any number of parameters. Every person with a Swedish national identification number must register a valid address, even if living abroad, since sent letters are considered to have arrived. Income is not considered by the major credit bureaus when calculating a credit score.

Everyday, companies target consumers who have poor credit histories with promises to clean up their credit report so they can get a car loan, a home mortgage, insurance, or even a job once they pay them a fee for the service. Letters with payment requests did not reach him on time. It is used by many mortgage lenders that use a risk-based system to determine the possibility that the borrower may default on financial obligations to the mortgage lender.

No one can remove accurate negative information from your credit report. Days ago established by the small business small business loans jobs act of the act, the small business. You also can ask that a corrected copy of your report be sent to anyone who received a copy during the past two years for employment purposes. You can use the form in this brochure, or you can print it from ftc.gov/credit. It is estimated that FICO score will remain the dominant score but in all likelihood it will always be used in conjunction with other alternative credit scores which offer new layers of risk insights.

Some people hire a company to investigate on their behalf, but anything a credit repair clinic can do legally, you can do for yourself at little or no cost. The truth is, these companies can’t deliver an improved credit report for you using the tactics they promote. If you are considering filing for bankruptcy, be aware that bankruptcy laws require that you get credit counseling from a government-approved organization within six months before you file for bankruptcy relief.

Used Car Listings

Simply due to this lack of information to the consumer, it is impossible for him or her to know in advance if they will pass a lender's credit scoring requirements. Vendo persiana y bases de neblineras toyota hilux en guatemala par repuestos y. It is very difficult for a consumer to know in advance whether they have a high enough credit score to be accepted for credit with a particular lender. If possible, find an organization that offers in-person counseling.