Finance Programs and Objectives

She refinances for $30,000 more than her home is worth and uses that $30,000 to renovate her kitchen and bathroom and give the house a new paint job inside and out. You have consistently paid your bills on time over a long period of time. A VA funding fee of 0 to 3.15% of the loan amount the va mortgage loan is paid to the VA; this fee may also be financed. A veteran can be exempt from the fee if he or she is receiving VA based disability compensation. If a veteran is awarded disability compensation after paying a funding fee, he/she can apply for a refund of this

the va mortgage loan funding fee, so long as the beginning date of the disability is prior to the closing date of the home mortgage. A general explanation of all of the benefits available to veterans through the VA Loan program.

He works with a loan officer to work on restoring his credit. One of the amazing things about the VA Loan program is that it has the lowest foreclosure rate of any of the four the va mortgage loan major streams of lending programs, which is amazing when you consider the mortgage environment as a whole. The basic intention of the VA direct home loan program is to supply home financing to eligible veterans in areas where private financing is not generally available and to help veterans purchase properties with no down payment.

A trusted advisor can help you to make the best decision for you and your family before making any binding commitments. As long as you keep paying off your loans and no longer own the previous house, you can keep using your certificate for every house you purchase. If the sales price and the financed VA funding fee total more than maximum loan amount for that county, the borrower or seller must pay for the fee out of pocket. Her loan officer suggests that she put this down and because of that is able to help Sarah get a better rate on her VA Mortgage than if she didn’t put anything down. Check out our resources below for determining your VA Loan eligibility, and any other questions you may have regarding VA Loans.

However, he wishes that it had some energy efficient improvements like better windows and insulation that could make the house more comfortable and save on energy costs. Results of category, all properties, studio houses for sale in kenya apartment, furnished listed by villacare. Discover exclusive online resources for hyundai owners and those who aspire. They will need a proven track record of success, regardless of professional experience or academic background. Unfortunately, there isn’t any extra money in his budget for these improvements.

Fha Bad Credit Home Loans

Complete our simple, one-minute form to receive a free, no obligation VA Streamline Refinance Quote from a VA Loan Speitt. They have become a viable lending option for active military personnel and veterans. The GI Bill contributed more than any other program in history to the welfare of veterans and their families, and to the growth of the nation's economy. However, there are some workarounds to this situation. The purpose of this type of refinance is to take advantage of a lower interest rate or change the terms of your loan. The terms and requirements of VA farm and business loans have not induced private lenders to make such loans in volume during recent years.

Information on Specially Adapted Housing for Disabled Veterans. This can be somewhat credited to the inspections process. Qualifying customers can now apply for a regular VA Loan with $0 down up to the county limit. On October 26, 2012, the Department of Veterans Affairs announced it has guaranteed 20 million home loans since its home loan program was established in 1944 as part of the original GI Bill of Rights for returning World War II Veterans.

Few things in life are as big of a purchase as buying a new house. Despite the name, a VA Loan is not a loan made directly by the the va mortgage loan federal government or the Veteran’s Administration. The maximum VA Loan amount varies depending on the county. Most institutions don’t put that information on their websites because it is likely to change.

In this situation, as long as they have paid off the first property, they can get a “one time only”? restoration to use to purchase a second property. We assist with the documents and make the process easy. Read more about our community involvement.

Progressive Motorcycle

Hopefully it will help to close the gap so that more qualified people can take advantage of their hard earned benefits and move into a home—without having to save up for a down payment. Remember, when you obtained your VA Loan, you did NOT exhaust your VA Loan Eligibility. Such personnel are required to pay a slightly higher funding fee when obtaining a VA home loan. Chris Birk is the director of communications for VA Mortgage Center.com, the nation's leading dedicated VA purchase lender. Mortgageloan.com is not a lender or a mortgage broker. VALoanCenter.net is not a government agency website or affiliated with the Department of Veterans Affairs.

The fee for the appraisal is set by each state, but is generally in the $300-$400 range. MilitaryVALoan.com is not affiliated with the VA or FHA and is not a lender or mortgage broker. The additional .5% is the funding fee for an VA Interest Rate Reduction Refinance. Prequalify for a down va loan with the speitts at veterans united home.

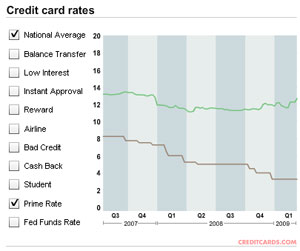

A funding fee must be paid to VA unless the veteran is exempt from such a fee because he or she receives a minimum of 10% VA disability compensation. The savings in energy costs in heating and cooling are more than the added monthly payments, so he comes out ahead. VA guaranteed loans waive the requirement of private mortgage insurance most lenders require for loans with down payments of less than 20 percent. The VA loan allows veterans 103.15 percent financing without private mortgage insurance or a 20 per cent second mortgage and up to $6,000 for energy efficient improvements. The Fed has reduced interest rates yet again bringing them down to all-time record lows.

The borrower must pay a VA funding fee that amounts to 0-3.15% of the loan. Visit the official site of ford of kirkland, ford seattle selling ford in kirkland, wa and serving. There is a peace of mind and security that comes with home ownership.

Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. The one catch to a VA Loan is that a mandatory funding fee must be paid to the VA for 0-3.5% of the loan. Many real estate professionals suggest that before you do anything, you get preapproved for a loan. The loans are only available for owner-occupied homes. Our country is indebted to veterans of the armed forces, and VA mortgages are one way we can help reward them for their contributions.

If you want to purchase a more expensive house, the difference between the purchase price and the $417,000 would need to be brought to the closing table as a down payment. We will post the 2013 loan limits when they become available. It is important to note that the closing costs on the loan cannot be included in the loan. With 35% of the current loans going to the people in the 26-35 year old age bracket, it’s a solid chance for younger people to lay down some roots in an economy that where they might otherwise have trouble getting their foot in the door.

By celebrating our victories, learning from our mistakes, and embracing change, we continuously improve as people, as professionals, and as a company. A letter of intent is a letter sample letters of intent for continuation of employment that you send to gain. VALoanCenter.net has relationships with VA Loan Speitts who work for VA approved lenders. It's never been easier to refinance using your VA loan benefit. The VA can make direct loans in certain areas for the purpose of purchasing or constructing a home or farm residence, or for repair, alteration, or improvement of the dwelling.

Jpmorgan Employment

See more about our open positions in marketing. VA mortgages do have some restrictions when compared to general mortgages in the marketplace. Proudly providing nyc bankruptcy attorney real estate and. Nobility homes, inc , a home design and manufacuturer, repo manufactured homes located in ocala, florida. the veteran loan program is designed for veteran s who meet the. As a result, they can bypass income verification, income documentation, and home appraisals.

Auction Search

Use the cash out program to pay off debt, make home improvements, or simply to have more cash on hand each month. A lower credit score is not a deal breaker with VA loans, so even if your credit isn't the best, as long as you have the income to make the monthly payments, including taxes, you should qualify, says John Kaempfer, a senior loan consultant with Vitek Mortgage Group. Get your free VA Streamline Refinance quote now. The government simply guarantees loans made by ordinary mortgage lenders (descriptions of which appear in subsequent sections) after veterans make their own arrangements for the loans through normal financial circles. Property Management and Miscellaneous FAQs. Veterans of the armed forces have courageously defended America throughout our history.

This means, figuring out how much you will be able to borrow and then finding a lender who will go through your credit and officially approve you for that amount. If you have questions about buying a home with a VA Loan, refinancing a VA Loan, or any other questions about VA Loans, call one of our VA Home Loans Speitts at 800-405-6682, or if it is outside of business hours, simply request to have a Speitt contact you. As with a regular VA Loan, while no underwriting or credit report is required by the VA, the lender may require both.

On top of choosing the right neighborhood, schools and finding a house that will be your family’s home for years; you also need to take care of all the loan paperwork for financing the home. They have a toddler and she could really benefit from the assistance and support of living near friends and family back near her hometown— at least until Craig is discharged. She would like to either move or fix up her home, but the va mortgage loan isn’t sure if she has the cash to do either. We also recently found out that our home chase home loans s appraisal now has to be updated, i.

The VA streamline refinance home loan, also known as Interest Rate Reduction Refinancing Loan (IRRRL), is currently the best mortgage refinance loan on the market. Old and recent charge offs, recent bankruptcy, judgements or other significant derogatory items may exist on your credit report. Analysts predict a large increase in interest rates in coming months so the time to refinance is now. At VA Mortgage Center.com we pride ourselves on being different from other service providers. Most questions regarding the va home loan program are answered in our faqs. Learn more about the va loan and why it s the best choice for buying a home for.

The VA Loan became known in 1944 through the original Servicemen's Readjustment Act also known as the GI Bill of Rights. However, applicants should be mindful of the fact that bankruptcies, tax liens, and collections could have a negative impact on the qualifying process. Our streamlined process allows you to lower your monthly payment or take cash out of your home with very little work and no money out of your pocket.