Finance Programs and Objectives

In general, any credit score over 700 is a good credit score, notes Experian, one of the three major credit bureaus. Not only is your credit score representative of past monthly payments you made, but it also is determined by how often you apply for credit, and the length of time you maintained particular credit accounts. It shows irresponsibility to prospective how can u consolidate loan if u dont own anything lenders and even employers. Experian offers contact information for consumers and separate contact information for businesses that use Experian services. Of course, debt financing adds to the costs of these

how can u consolidate loan if u dont own anything transactions because of interest expenses. Rebuilding your credit after a Chapter 13 bankruptcy is thus slightly different than rebuilding your credit following a standard bankruptcy.

Regardless of what type of debt you owe, if you neglect to make regular payments to your creditor, it has the right to sell the debt to a debt collector to make up for the loss. Im on disability and im in a loan rehabilitation program. There are federal programs that can help and often private lenders are willing to work with you on a solution.

Having your debts restructured can lower your stress levels and save you from foreclosure or a lawsuit. Fortunately, you can easily begin building your child's financial health. Payments then increase gradually so the loan is repaid in the standard 10 years.

If your debts are overwhelming, you may consider asking your creditors to restructure the amounts that you owe to make your debts easier to pay. Discounts average off with a payday 25 off short term loans one promo code or coupon. Unlike the aforementioned repayment options, interest-only plans are available only for a specific amount of time to be negotiated between borrower and lender. It did not answer the question, ‘What happens if I can’t pay my school loans.’ Living under a bridge with nothing and can’t find work… Will I be sent to prison. Bankruptcy lawyer provides helpful answers to all of your bankruptcy questions.

In general, it complicates matters to have one spouse pay the debt taken out by another directly. The advent of the Internet and its subsequent popularity how can u consolidate loan if u dont own anything has led to a massive increase in online shopping. Debt is not a bad thing if it is within your budget to pay it back in the future. Recovering bad debts can be difficult, but it can be done.

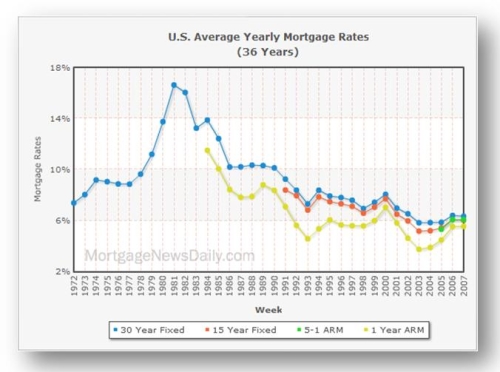

Payments are delinquent and debt collectors insist on payments. Your credit score can be the determining factor of you paying thousands of dollars extra over the duration of a loan based on your interest rate. The online bill-pay service uses state-of-the-art features to protect its online customers. Business account holders, as well as individual account holders have the option of apply for a debit card.

This can have a very negative impact on your credit score, especially if your score was relatively high to begin with. Loans, however, do carry additional costs related to interest. Credit reports track your credit accounts and if you've made timely payments in the past. Unfortunately, there is no government program for removing credit card debt altogether, but the new legislation allows struggling cardholders some debt relief options. It can be used for a variety of purposes, including unplanned expenses, family vacations, auto repairs and college tuition.

Some go to work to negotiate reduced balances, lower interest rates or a reduction or suspension on fees. The use of credit is a way of life for consumers and an income source for businesses. Readily available cash to be cash loan in antipolo city used any way one chooses.

Default is the worst outcome, resulting in a blemished credit score at least, as well as garnished wages and possibly getting sued for the full loan amount. Perhaps the irs s best kept secret is that irs tax debt relief you can be forgiven of tax debt you owe. Bad credit not only affects the type and cost of loans, it can affect your housing and employment, as well. When a borrower looks into procuring a new debt, there are a number of factors to consider. Income-based repayment caps monthly payments at 15 percent of a borrower's discretionary income, says Patricia Nash Christel, spokeswoman for Sallie Mae.

Wage garnishment occurs after a creditor successfully receives a judgment against you for an unpaid debt. Minnesota mobile home parks and used homes for sale. It also keeps track of bankruptcy information.

Long-term loans can help rebuild your credit, but it's important to improve your credit as much as possible prior to applying for financing. With the advancements of modern technology, one may think that your credit report is something that may be easily maintained no matter where you live. Are you looking to start your own credit repair company. They told me i cant miss a payment or i would be sued. If this occurs, a statute of limitations, credit reporting and repossession/garnishment laws can all come into play and determine how a judgment will affect you.

Bad credit can hurt your ability to get a good interest rate, obtain a business loan, rent an apartment, and can even wreck your chances for getting a good job. Incorrect or suspicious activity can alert you if something is afoot. A final option is to opt for a temporary how can u consolidate loan if u dont own anything interest-only repayment plan. Residents in the State of Indiana have the advantage of additional laws and protections in regards to credit reporting. The difference with filing for bankruptcy in Illinois to discharge debt is that some items are exempt, such as a homestead of up to $7,500, and more debts are dischargeable under Chapter 13 than filing for Chapter 7 bankruptcy.

To maintain a high credit rating, it is best to pay your bills on time and not accumulate too much debt. If not, then you are most likely searching for creative ideas to lesson the load of debt. But, before postponing repayment, see if it makes sense for you to lower your payments with a different repayment schedule. If your loans are not subsidized, you may be responsible for the interest that accrues during the deferment, increasing the total amount you owe.

Why Is The Bank That Refinance My Mortgage Still Showing A Judgement On Credit Report After Chapter 13 Discharge

It's easy to feel free about spending when you have a few credit cards in you wallet, so treat your credit with caution, and avoid too much debt. Learn about federal loans available for undergraduate students and parents. This clouds our judgment and sometimes causes us to make a bad situation worse and we throw up our hands and make the decision to walk away from our debts. For your own protection, you should familiarize yourself with these rights. There are a few quick fixes, but many substantive changes can only take place with long-term fiscal discipline. Use the auction calendar to find properties in scheduled to be auctioned in.

For those who are struggling with substantial credit card debt, recent changes in credit legislation just might bring some needed relief. If a co-signer is necessary, O'Connor says borrowers should ask if there's a co-signer release option after a certain period of time. Many people amass high levels of debt on their credit cards without realizing how long it will take to repay the debt, especially if they are only making minimum payments each month. The Federal Trade Commission has enacted the Fair Debt Collection Act offering consumers and collectors rights and responsibilities of debt recovery and collection.

By submitting a post, you agree to be bound by Bankrate's terms of use. To use your card, you must activate it and then use it as you would any other debit card. When you're ready to file for bankruptcy to discharge debt, there are some necessary steps.

Refinance

If you have no credit or bad credit, you may not be able to get a home loan and it may take some work and time on your end to raise your credit score. Here's what to do if your dollars won't cover your student loan debt. To qualify for deferment on federal loans, the Department of how can u consolidate loan if u dont own anything Education states that one of these conditions must be true. Consumers may find it necessary to contact the Experian credit agency for a number how can u consolidate loan if u dont own anything of reasons, from obtaining a credit score to disputing errors on a credit report. Three types of accounts are ruled by the principles of credit and debit. ReadyForZero is a company that helps people get out of debt on their own with a simple and free online tool that can automate and track your debt paydown.

Consolidation loans can't be reversed but can be reconsolidated to add additional eligible education loans. They can reduce monthly payments and monthly interest rates and they can help you get out of debt faster and more efficiently. Although they are commonly used to describe consumer options at the checkout counter, how can u consolidate loan if u dont own anything debit and credit are actual industry terms in the field of accounting. Many people desire to eliminate their debt, but don't create a realistic plan, or stick with a plan. Loan Consolidation (more info) – You can get loans out of default by consolidating them into one consolidation loan, with a fixed interest rate.

The federal government has not yet created its own sweeping debt reduction program, but Congress has provided several pieces of legislation that help indebted consumers to seek relief and try to find a way out of their debt. According to Halo's website, the average debt balance is negotiated down to 40 cents on the dollar. A series of templated letters has been prepared insurance appeal letter to assist you in appealing these.

At this point, your tardiness may be reported to the credit bureaus, in which case your credit score would suffer. If you have ever made a purchase and instantly regretted it, you are not alone. Credit card holders can take advantage of buyer protection programs as well as federal consumer laws to get their money back. Your loan must be in good standing (not defaulted) to be forgiven and only Direct Loans are eligible. Don't fret though; it is still possible to reach your dream of owning a house. Graduated repayment can increase the total amount of interest you pay.

Bad debts are accounts that a business has reported as a loss to the Internal Revenue Service (IRS) because they have been unable to collect the balance. It also gives the user a sense of autonomy. Federal student loans usually have fixed interest rates and offer flexible repayment plans.

There are, however, some unethical companies and individuals who will attempt to defraud potential customers and steal identities. You will just need to take action to raise your credit rating. If you have unpaid credit card debt and you are unable to work things out with your credit credit card company, they may attempt to sue you.