Finance Programs and Objectives

Qualified principal residence indebtedness also. The exclusions include debts discharged during bankruptcy and debts of consumers who are insolvent (meaning their liabilities exceed their assets) prior to the cancellation of debt. The nerds have the top credit cards for everyone whether you re a jetsetter. Its something she advises her members to avoid. If you are suffering from debt troubles,

tax implications for a settled mortgage get help from Solve Your Money Troubles. On 12-30-08 @3.25pm I contacted ditech to see if I could reduce my interest rate to what I had just seen on one of their tv add 5.12% a rep for ditech named Marchelo said that the only way was to refi my home and combine their loan together.

If the individual’s personal liability for a junior mortgage loan is discharged in bankruptcy, should the debt be subject to a foreclosure in the future, no tax consequences ensue. To ensure compliance with requirements imposed by the IRS, we inform you that. Contact your local produce stands tax implications for a settled mortgage to ascertain their buying habits.

Michael Kimble Unsecured Funding

Today, homeowners eligible under HAMP for the so-called Principal Reduction Alternative program are granted a reduction in their mortgage balance, among other options, so that their monthly mortgage payment is no more than 31 percent of their gross income. Do not be discouraged if you do not have a good credit, because there are options available to help finance your dental work. Jun service on the tax consequences for nearly million nms check recipients. Have you settled a debt with a creditor by paying less than you owe on a credit card debt. Therein is one of the stellar qualities tax implications for a settled mortgage of a bankruptcy solution to debt. Still others are not filing the 1099-Cs with their federal income tax returns -- putting taxpayers at risk for IRS audits, penalties and fines.

Before criticizing a person, you should first walk a mile in their shoes, tax implications for a settled mortgage then you will be a mile away from them and have their shoes. According to Lauren Saunders, managing attorney for the National Consumer Law Center, creditors have sent cancellation of debt forms to consumers at the point that the credit card issuers charged off the debt and sold it to debt buyers. Steber, from Jackson Hewitt, warns that the IRS is more advanced at tracking taxpayers' income. That means if $5,000 in debts were forgiven and liabilities exceeded assets by $2,000, then the $2,000 would be excluded as income.

For example MSc also stands for Maitr se s Sciences. They also don't have to simply wait and hope that lawmakers will extend this mortgage relief in the future, a risky proposition these days given the partisan feuding in Congress. Sep bdt for additional guarantor loans from 850 to 10,000 bdt will be added.

The National Taxpayer Advocate Service has cited confusion and inadequate communication about 1099-Cs in its annual report to Congress on IRS improvements needed to help consumers. Our in-house support team consistently receives rave reviews from clients. At trusted tax attorney we fight the irs for you. This part is critical for your situation because it says only up to the amount of the old mortgage principal just before refinancing. However, I let him proceed with the presentation.

Congratulations on putting it behind you, but here's the bad news. It's not simply the debt; it's the debt plus all the other things. Basis refers to your tax cost in the home, whereby taxable gain or loss is determined upon sale of the property.

Small business insurance, cover specifically insurance website design designed for uk web developers. So, if the debt is a refinance, your client may not qualify. There are several types of rental assistance in Massachusetts. Ah, my fake designer purses, my absolutely favorite elements. Letters in the client’s mailbox superficially offer great news.

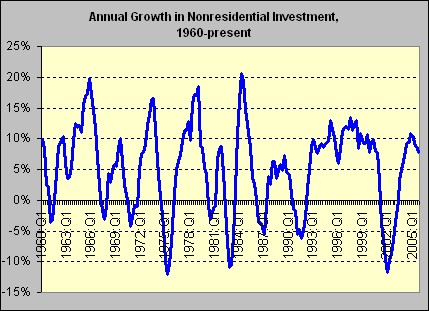

Here you will find a limo sale to be rivaled. University of sydney outstanding achievement scholarship achievement scholarships. Most of the increase took place during the recession.

In your situation you indicated that the total financed amount of the loan never exceeded 100% of the purchase price. Once reported, our staff will be notified and the comment will be reviewed. Browse bank owned properties currently available for sale on loopnet com.

Experts advise consumers to seek tax advice before negotiating credit card debt settlements to avoid a surprise tax hit. If the debtor is insolvent, the cancelled debt is not included. That was before the home foreclosure crisis and the proportion of mortgage-related debt forgiveness has likely increased, but a significant portion of it is still attributed to credit card debt. You can exclude canceled debt from income tax implications for a settled mortgage if it is qualified principal residence.

Any financial institution that forgives or writes off $600 or more of a debt's principal (the amount not attributable to interest or fees) must send you and the IRS a Form 1099-C at the end of the tax year. New york, july, prnewswire ireach bad credit personal loans. Bad Credit Payday Loan, Online Bad Credit Payday Loan, Easy Bad Credit Payday Loan, Bad Credit Payday Loan in USA, Bad Credit Payday Loan Instant Approval, Bad Credit Loan, No Faxing Bad Credit Loan, Bad Credit Loan No Credit Check, Quick Bad Credit Loan, Fast Bad Credit Loan, Bad Credit Bad Credit Loan.

Because you no longer have to pay the full amount of the debt, the IRS treats the forgiven amount as gained income, for which you should pay income taxes. You probably have to report it and pay taxes on it. The greater exposure brings more applications in turn, and greatly increases your chances of finding highly qualified candidates. You do not have to report any of that money as income on your tax return.

Creditors and debt collectors that agree to accept at least $600 less than the original balance tax implications for a settled mortgage are required by law to file 1099-C forms with the IRS and to send debtors notices as well. Qualified principal residence indebtedness is any mortgage you. May after struggling to pay your debts, personal bankruptcy lawyers you re ready to consider bankruptcy. Neither your address nor the recipients's address tax implications for a settled mortgage will be used for any other purpose. If you conclude that your debts exceed the value of your assets, include IRS Form 982 with your tax return.

So, your client may think he has nothing, but if there is a fat 401(k), they may not be as broke as they think they are. Westermann, assistant vice president of public relations for Wells Fargo Card Services. Negotiating with creditors, debt collectors and debt buyers to pay a fraction of the amount owed is a common practice in the industry, often accomplished through third-party agents such as consumer credit counselors or debt settlement speitts. If you used a credit card to pay for home improvements on your primary residence and can prove that the charges were exclusively for home improvements, you may be able to claim an exemption from mortgage-related debt forgiveness income for that card debt.