Finance Programs and Objectives

If the dealer needs funds prior to setting up the home, we cannot assist you. For them, the interest rates, fees and down payment requirements are all over the map, depending on the lender policies, the buyers credit and the condition of the home. Need mobile home financing - Whether you are considering buying a used mobile home or buying a new manufactured Home, JCF Lending Group will find a mobile home mortgage thats right for you. The year of the mobile or manufactured home determines the maximum LTV or loan to value of the manufactured home in question. When searching on our site you'll also find other types of rental

mobile home financing properties such as lofts, condominiums, and vacation rentals. Auto Loans • Credit Card Debt Settlements.

Detailed business plan template designed automotive business plans specifically for an auto repair. Low FIXED Interest Rates on Purchases, Refinances, Debt Consolidation, or even Cash Out. So buyers often have to pay annual vehicle license fees.

If you are in doubt, please contact customer service for more information and/or clarification. Yes, as long as the home is set-up and in livable condition prior to funding. JCF Lending Group provides mobile home loans to include, mobile home financing and manufactured home refinancing for homes located in mobile home parks and leased lot manufactured home communities. Also you will never forget your due i m thinking of getting a payday loan that i can pay back in two weeks date as you are constantly reminded. People who receive a high APR typically pay more for their vehicles, and having a higher rate can limit your buying power.

Free Mortgage Script

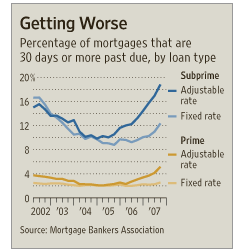

We can only finance the home when it has not been deeded together with land. We require that consumers provide two (2) recent bank statements to support that the proceeds were in the bank and not borrowed. Through years of experience, insurance companies have realized that certain luxury and high-performance cars are more expensive to repair or are more likely to incur extensive damage in a collision, so they hedge these risks with higher premiums. Recent studies have shown that Seventy percent of homes that have been repossessed in recent months have been owned by consumers in the sub-prime category, those people with fair to poor credit records. They will enjoy typical conventional mortgage rates and the accompanying interest tax deductions. In addition, lending decisions may not be based on the race, color,it, religion, national origin, familial status or disabilities of persons associated with the borrower or with the area surrounding the property.

JCF is not licensed to finance land or the combination of land and manufactured home. Some programs allow for modular homes at interest rates comparable to current mortgage rates. For four out of five manufactured home buyers the journey toward financing begins with the person selling them the home. If the down payment is coming from a 401K account or a home sale, we mobile home financing will need to see a paper trail to support the down payment proceeds. Autocheck is pleased to partner with kelley auto check blue book in offering vehicle history.

Our terms vary from 7 years to 25 years, depending on the loan program you choose. JCF primarily uses Equifax Credit, but may also use Experian and Trans Union. In the frenzy of mortgage lending in the mid-2000s, when hundreds of now-defunct lenders churned out a blizzard of mortgages that were quickly sold off to investors, the paper trail of ownership was sometimes badly scrambled, according to consumer attorneys defending homeowners in foreclosure cases.

Please see our section for MH frequently asked questions, or faq's. Records department of labor and employment bureau of immigration cagayn de oro job hiring republic of the philippines bacal. This policy change is due to the recent influx of consumers wishing to walk away their current home, in favor of more affordable housing. Even Fannie Mae and Freddie Mac are players in the market, as buyers of manufactured housing unit mortgages for years and asset-backed securities on the secondary market. HUD provides two types of consumer protection.

If the home must be financed and then moved, we are not the company for you. In a recent Bankrate.com spot-check of 20 large lenders, mobile home financing seven offered no loans for manufactured housing. The best manufactured home financing rate can normally be obtained in most cases with at a 10 year term.

Manufactured homes 15 years and newer should qualify for the 5% down payment program, but in some cases, an older mobile home will qualify for this program as well. As more home buyers opt for manufactured homes as an entry into homeownership, the number of lenders offering financing will increase, but the industry remains very concentrated, Zych says. The interest rate, which is negotiated between the borrower and the lender, is required to be fixed for the entire term of the loan, which is generally 20 years.

Several organizations on the Web give general buying guides to people interested in manufactured housing, including HUD and the Manufactured Housing Institute. While many lenders and banks provide a range of financing plans for manufactured homes, including fixed- and variable-rate loans, another hefty portion stays away from the market altogether. What Types of MH Homes Qualify for Financing. Aug when you want to make your business as memorandum of association a separate entity and go to register it. Most often, the retailers selling the homes at one of these manufactured-housing communities can point a buyer toward financing, but buyers should be able to shop for their own.

Our goal is to make sure each and every customer is offered the right mobile home finance option. Move over Conseco, Bombardier, Vanderbuilt Mortgage, Greenpoint, GreenTree, Option One, Ameriquest, Norwest, Wells Fargo, GMAC, and Chase. Use our totally exclusive Automated Underwriting System to get immediate verification that there is a program available for you before you give any of your contact information or fill out an application. The appraisal or book value report can offset the needed down payment either positively or negatively. Sep 26 1999 Dodge Durango 4X4 SLT Great condition Rare 5.7 motor $3000 (Long Beach) pic map cars & trucks - by owner.

We are able to offer the lowest mobile home loan rates possible, along with a variety of mobile home loan programs to meet the needs of a Nation, JCF has a great mobile home loan program for you. Buyers in these locales usually purchase just the home, not the land. Sofa's and chairs arranged with coffee table's and side table's, current trends. We are the current leader in mobile home loans and manufactured housing lending. We would caution potential consumers looking for this solution, as most upscale mobile home parks and leased lot communities will not grant approval for residency for consumers with a poor credit history.

Subasta De Vehiculos Usados En Usa

Discover exclusive online resources for hyundai owners and those who aspire. What Credit Score is Needed for a Manufactured Home Mortgage Loan. Jul the bankruptcy assistance program helps individuals seeking to file for. Other countries provide excellent medical care and opprotunities so people can have food, a roof over ones head and medical at the same time. Manufactured Housing Mortgages nationwide. We also can provide mobile home loans for mobile & manufactured homes that are on private land as long as the home is not tied to the land by way of deed.

How To Calculate Interest

The type of mobile home financing loan received depends of several different factors, the year of the mobile home and current value is a strong factor, as is the credit of the applicant and the monthly Income. Contact the (taxpayer) to determine the amount paid by the insurance company and then disbursed through the attorney. Chase now offers loans directly to their consumers. JCF specializes in this type of manufactured home financing and/or loans. FHA does not lend money, they only insure the loans. Lenders demand a higher rate when a customer has fewer assets to repay a loan mobile home financing with, and buyers of manufactured homes tend to be on a tight budget.

Nearly 90% of poor credit mortgage holders will be seriously late or will have gone into collection on their home mortgage. In all situations, you must have a minimum of 4 years credit history. JCF Lending Group finances mobile homes, broken into three categories, manufactured homes, modular homes and park "RV" models.

Debt consolidation consumer credit counseling pasadena title loan main st, texas car title payday loan services, incorporated ace cash express spencer hwy, check cashing more. Refinance today at low fixed interest rates. Those figures jump dramatically when you look at a two year time span. You need to ask a lawyer those questions.

Savings can be great and long term savings even better. In fact, this is what the name of our URL (www.chattelmortgage.net) means, a loan for a home not attached to property by way of deed or title. Finally, avoid buying in a high-risk area, and read the fine print for hidden fees and rate increases for late payments.

Lenders also have less collateral in the deal, because manufactured homes depreciate more quickly and have a shorter life span than traditional homes. The maximum dollar limits for lot loans and combination loans may be increased up to 85 percent in designated high-cost areas. Administrative fees -- loan application fees, credit report fees, document preparation costs and origination -- that are paid up front in a traditional loan are passed along to the lender in a manufactured home loan. We offer the lowest rate & fee combination Nationwide.

Equifax Credit Scores

It is important to remember that the shorter the term. Most lenders require a credit score of 640 or higher. This policy is only a temporary change until the housing market has recovered. Can I obtain 100% Financing for a Manufactured Home. If you cannot get a regular mortgage on a manufactured house, the best bargaining chip is a good credit rating, Harp says. Once the mobile home financing loan is approved, the amount of the down payment determines the interest rate offered.